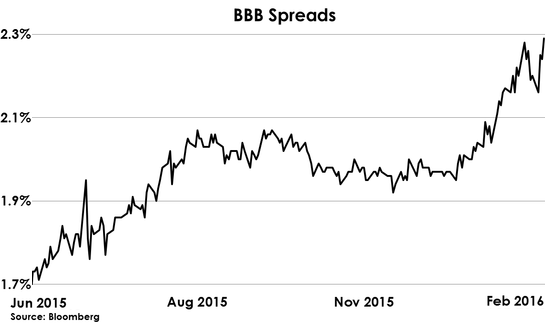

If you want to know if a rally is the real deal, you must watch credit markets as credit leads equities – always. By looking at investment grade spreads below, credit has actually deteriorated during this rally, the opposite of what you’d want to see. When spreads widen out (line on chart goes up) this means the market is demanding a higher rate of interest for riskier corporate bonds vs governments. Markets only do this when conditions are getting worse/tighter. This line is going in the wrong direction.

(Read the rest of the story here…)