For many former state workers, a monthly public pension check is their bread and butter in retirement.

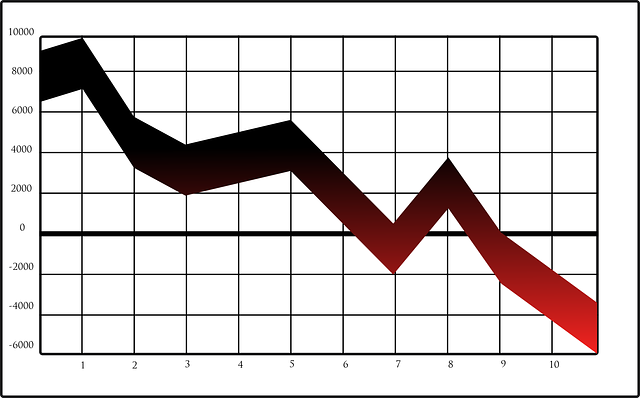

But the gap between what states have promised retirees and how much is saved to fund those payments has grown, according to a new report from Pew Charitable Trusts. States are short $968 billion for their pension systems, an increase of $54 billion over the year before. When debts from local programs are taken into account, the total shortfall tops $1 trillion, according to the report.

Three states — Illinois, Kentucky and Connecticut — have less than half of their pension programs funded. Illinois is in the hole by more than $100 billion.

(Read the rest of the story here…)