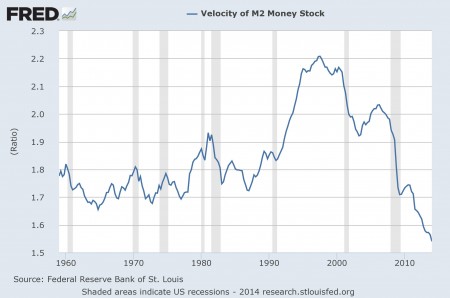

When an economy is healthy, there is lots of buying and selling and money tends to move around quite rapidly. Unfortunately, the U.S. economy is the exact opposite of that right now. In fact, as I will document below, the velocity of M2 has fallen to an all-time record low. This is a very powerful indicator that we have entered a deflationary era, and the Federal Reserve has been attempting to combat this by absolutely flooding the financial system with more money. This has created some absolutely massive financial bubbles, but it has not fixed what is fundamentally wrong with our economy. On a very basic level, the amount of economic activity that we are witnessing is not anywhere near where it should be and the flow of money through our economy is very stagnant. They can try to mask our problems with happy talk for as long as they want, but in the end it will be clearly evident that none of the long-term trends that are destroying our economy have been addressed.

Discussions about the money supply can get very complicated, and that can cause people to tune out, but it doesn’t have to be that way.

To put it very basically, when there is lots of economic activity, there is lots of money changing hands.

When there is not very much economic activity, the pace at which money circulates through our system slows down.

That is why what is happening in the U.S. right now is so troubling.

(Read the rest of the story here…)