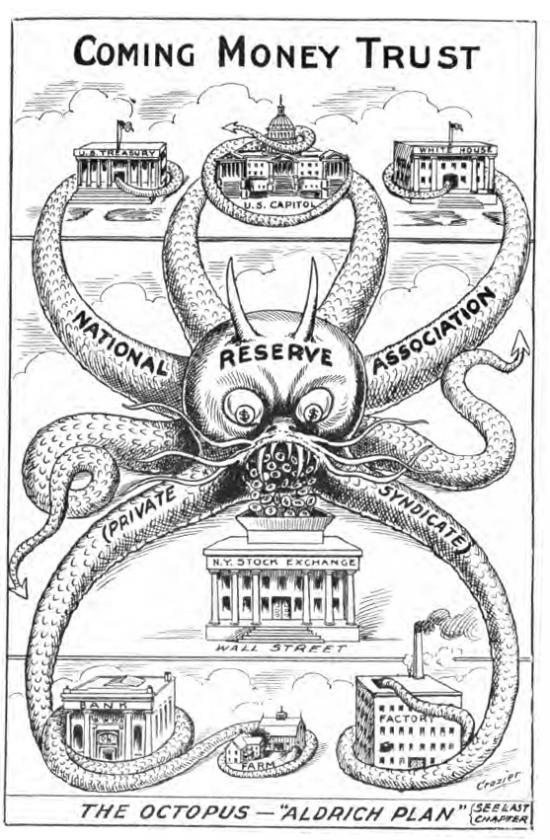

Federal Reserve

The Federal Reserve Is At The Heart Of The Debt Enslavement System That Dominates Our Lives

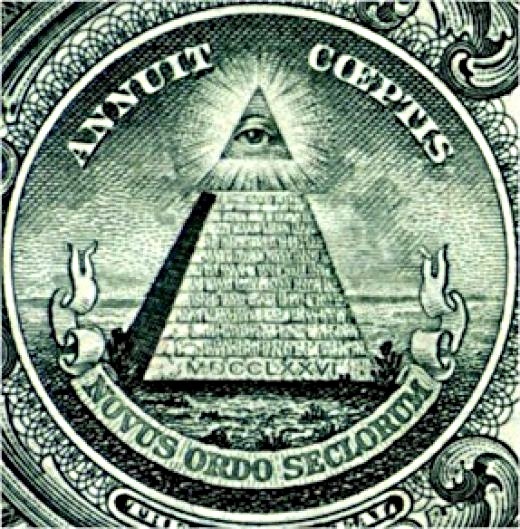

From the dawn of history, elites have always attempted to enslave humanity. Yes, there have certainly been times when those in power have slaughtered vast numbers of people, but normally those in power find it much more beneficial to profit from the labor of those that they are able to subjugate. If you are forced to build a pyramid, or pay a third of your crops in tribute, or hand over nearly half of your paycheck in taxes, that enriches those in power at your expense.