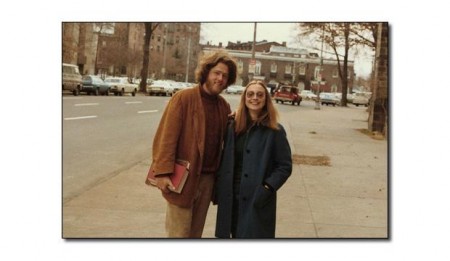

Bill and Hillary Clinton have long supported an estate tax to prevent the U.S. from being dominated by inherited wealth. That doesn’t mean they want to pay it.

To reduce the tax pinch, the Clintons are using financial planning strategies befitting the top 1 percent of U.S. households in wealth. These moves, common among multimillionaires, will help shield some of their estate from the tax that now tops out at 40 percent of assets upon death.

The Clintons created residence trusts in 2010 and shifted ownership of their New York house into them in 2011, according to federal financial disclosures and local property records.

Among the tax advantages of such trusts is that any appreciation in the house’s value can happen outside their taxable estate. The move could save the Clintons hundreds of thousands of dollars in estate taxes, said David Scott Sloan, a partner at Holland & Knight LLP in Boston.

“The goal is really be thoughtful and try to build up the nontaxable estate, and that’s really what this is,” Sloan said. “You’re creating things that are going to be on the nontaxable side of the balance sheet when they die.”

The Clintons’ finances are receiving attention as Hillary Clinton tours the country promoting her book, “Hard Choices.” She said in an interview on ABC television that the couple was “dead broke” and in debt when they left the White House in early 2001. After being criticized for her comments, she told ABC’s “Good Morning America” that she understood the financial struggles of Americans.

Capping Exemption

Having lost the Democratic presidential nomination to Barack Obama in 2008, Hillary Clinton is now deciding whether to run again in 2016.

In her last campaign, Clinton supported making wealthier people pay more estate tax by capping the per-person exemption at $3.5 million and setting the top rate at 45 percent, a policy Obama still supports. Congress decided to go in the other direction and Obama went along as part of a broader compromise. The per-person exemption is now $5.34 million.

“The estate tax has been historically part of our very fundamental belief that we should have a meritocracy,” Hillary Clinton said at a December 2007 appearance with billionaire investor Warren Buffett, who supports estate taxes and is using charitable donations to reduce his eventual bill.

Read the rest of the article at: www.teaparty.org