U.S. National Debt

It Will Take 398,879,561 Years To Pay Off The US Government’s Debt

The current debt level of over $17.9 trillion would thus take more than 398 million years of working at the average wage to pay off. This means that even if every man, woman and child in the United States would work for one year just to help pay off the debt the government has piled on in their name, it still wouldn’t be enough.

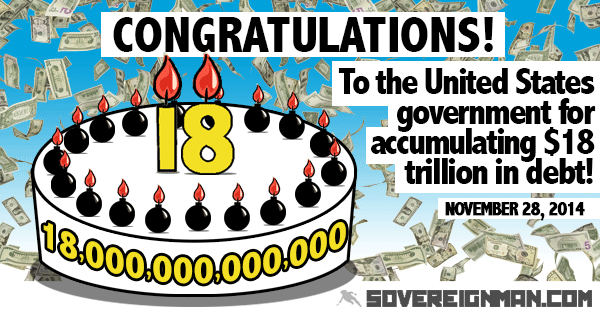

The National Debt Has Increased By More Than A Trillion Dollars In The Last 12 Months

The idea that the Obama administration has the budget deficit under control is a complete and total lie. According to the U.S.