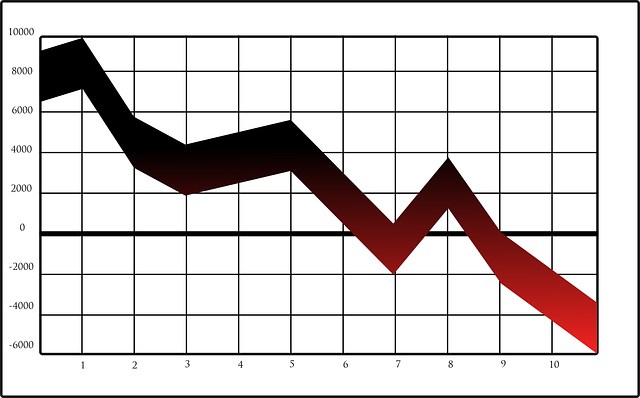

Europe Is Crumbling Into Collapse

The intention was always to make the EU a tide to lift all boats, or even, in the wildest dreams, a boat to lift all tides. That intention has failed in dramatic fashion. But not one single one of the architects and present day leaders is ready to fess up to their failures.