Financial Crash

The glaringly obvious guide to the next financial crash

Leveraged loans to private equity are not just flashing red but have a wailing siren and a man walking in front waving a flag. The loans are even bothering the see-no-evil officials at the Federal Reserve, who have been trying to persuade banks that excessively leveraged loans are risky. More than a third of leveraged loans this year have lent more than six times earnings before interest, tax, depreciation and amortization, only slightly below the proportion at the peak of the 2007 credit bubble, according to S&P Capital IQ.

Super-rich rush to buy ‘Italian Job’ style gold bars

The super-rich are looking to protect their wealth through buying record numbers of “Italian job” style gold bars, according to bullion experts. The number of 12.5kg gold bars being bought by wealthy customers has increased 243pc so far this year, when compared to the same period last year, said Rob Halliday-Stein founder of BullionByPost.

Only a monetary ‘nuclear bomb’ can save Italy now

If so, Italy’s public debt will spiral to dangerous levels next year, ever further beyond the point of no return for a country without its own sovereign currency and central bank. “This is catastrophic for the finances of the country. We’re heading for a debt ratio of 145pc next year,” said Antonio Guglielmi, global strategist for Mediobanca.

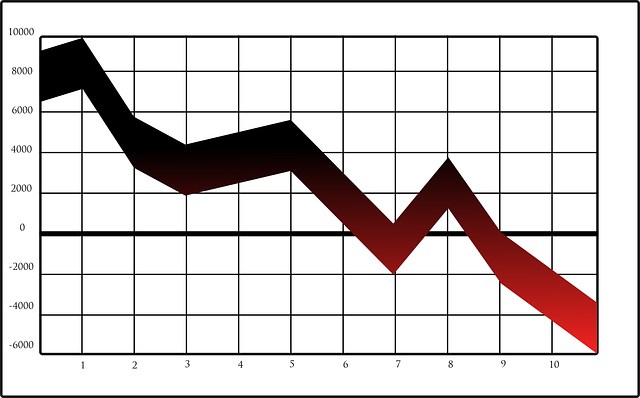

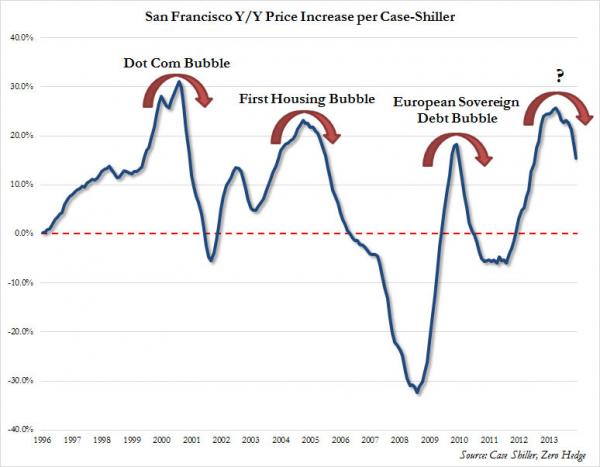

Most People Don’t Believe It, But We Are Right On Schedule For The Next Financial Crash

People have such short memories. Even though we are repeating so many of the same patterns that we witnessed in 2000-2001 and 2007-2008, most people do not think that another financial crash is coming. In fact, with the stock market setting record high after record high lately, I have been taking quite a bit of criticism for my relentless warnings about the coming financial storm.