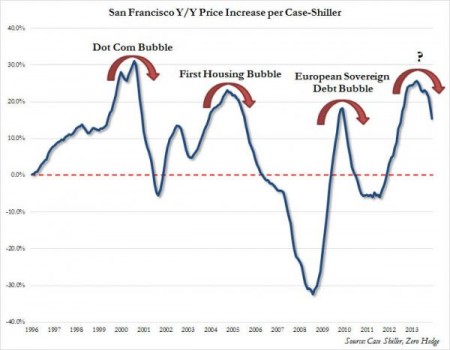

(Zero Hedge) The answer is still unclear. But what the chart below shows is quite clear: the relentless appreciation in the San Francisco housing market is over, and after rising by 18.2% in April, in May the San Fran market posted a mere 15.4% Y/Y price increase: the lowest since 2012. And while the Fed’s liquidity injections continue, if only for a few more months, and the second dot com bubble is clearing raging as the recent ridiculous Zillow-Trulia deal confirmed, it appears that the “?” bubble (as defined) is now well in its deflationary phase. Any attempts to restore the upmove will certainly require trillions more in fresh liquidity.