Global Economy

3 Of The 10 Largest Economies In The World Have Already Fallen Into Recession – Is The U.S. Next?

Are you waiting for the next major wave of the global economic collapse to strike? Well, you might want to start paying attention again. Three of the ten largest economies on the planet have already fallen into recession, and there are very serious warning signs coming from several other global economic powerhouses.

Israel economy shrinks for first time in more than 5 years

Israel’s economy contracted for the first time in more than five years in the third quarter, as growth was hit by the effects of a war with Islamist militants in Gaza. Gross domestic product fell 0.4 percent in the July-September period, the Central Bureau of Statistics said on Sunday.

David Cameron warns of looming second global crash

David Cameron has issued a stark message that “red warning lights are flashing on the dashboard of the global economy” in the same way as when the financial crash brought the world to its knees six years ago. Writing in the Guardian at the close of the G20 summit in Brisbane, Cameron says there is now “a dangerous backdrop of instability and uncertainty” that presents a real risk to the UK recovery, adding that the eurozone slowdown is already having an impact on British exports and manufacturing. His warning comes days after the Bank of England governor, Mark Carney, claimed a spectre of stagnation was haunting Europe.

5 reasons to worry about the world economy

There’s little reason for cheer in Europe. While Germany narrowly avoided a recession in the third quarter, the latest numbers show the $13 trillion eurozone economy is stuck in first gear. High unemployment, high debt and a lack of investment continue to hold the region back.

Specter of deflation looms over Fed’s return to normal

After months of focus on slack in U.S. labor markets, the Federal Reserve faces a new challenge:

The World’s 2nd-Biggest Retailer Is Getting Hammered As Profits Collapse 90 Percent

Tesco’s results are out Thursday for the first half of the year, and a breakdown of the results shows just how badly the company is being hammered. Shares are down by 6.39% well into London’s trading day Thursday, adding to the last month’s brutal sell-off.

If you have $3,650, you’re among the wealthiest half of people in the world

Global wealth grew by 8.3pc – its fastest rate ever – over the last year, reaching a worldwide total of $263 trillion, according to Credit Suisse’s Global Wealth Report for 2014. From average worth to millionaire growth, here are the other numbers you need to know.

Recovery? 60% Of Greeks Live At Or Below Poverty Levels

While Greek government yields (and political leaders) proclaim the troubled peripheral European nation is ‘recovering’, the risk of major political upheaval in Greece has not gone away ahead of next year’s presidential vote next year. As Reuters notes, under growing pressure from anti-bailout leftists, Greek Prime Minister Antonis Samaras desperately needs a new narrative to get the backing of lawmakers and rally Greeks fed up with four years of austerity. We wish him luck as Keep Talking Greece notes, it is high time that the real data of the economic situation of the Greek society come to the surface and so it did this week.

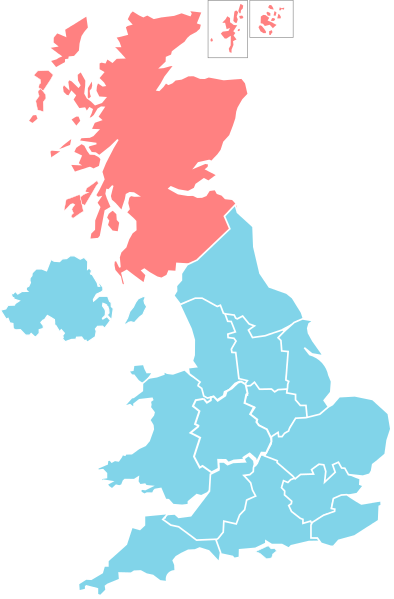

Get your money out of Britain: Global banks warn investors ‘Yes’ vote would be ‘cataclysmic’ for UK economy

International investors have been warned to pull their cash out of Britain to protect themselves against the ‘cataclysmic’ impact of Scottish independence. Japan’s biggest bank, Nomura, warned sterling could plunge by 15 per cent in the event of a ‘Yes’ vote – amid warnings over a ‘run on UK assets’ threatening savings and pensions of ordinary families. It came as it emerged David Cameron has pleaded with business chiefs to publicly warn against Scottish independence.