Investments

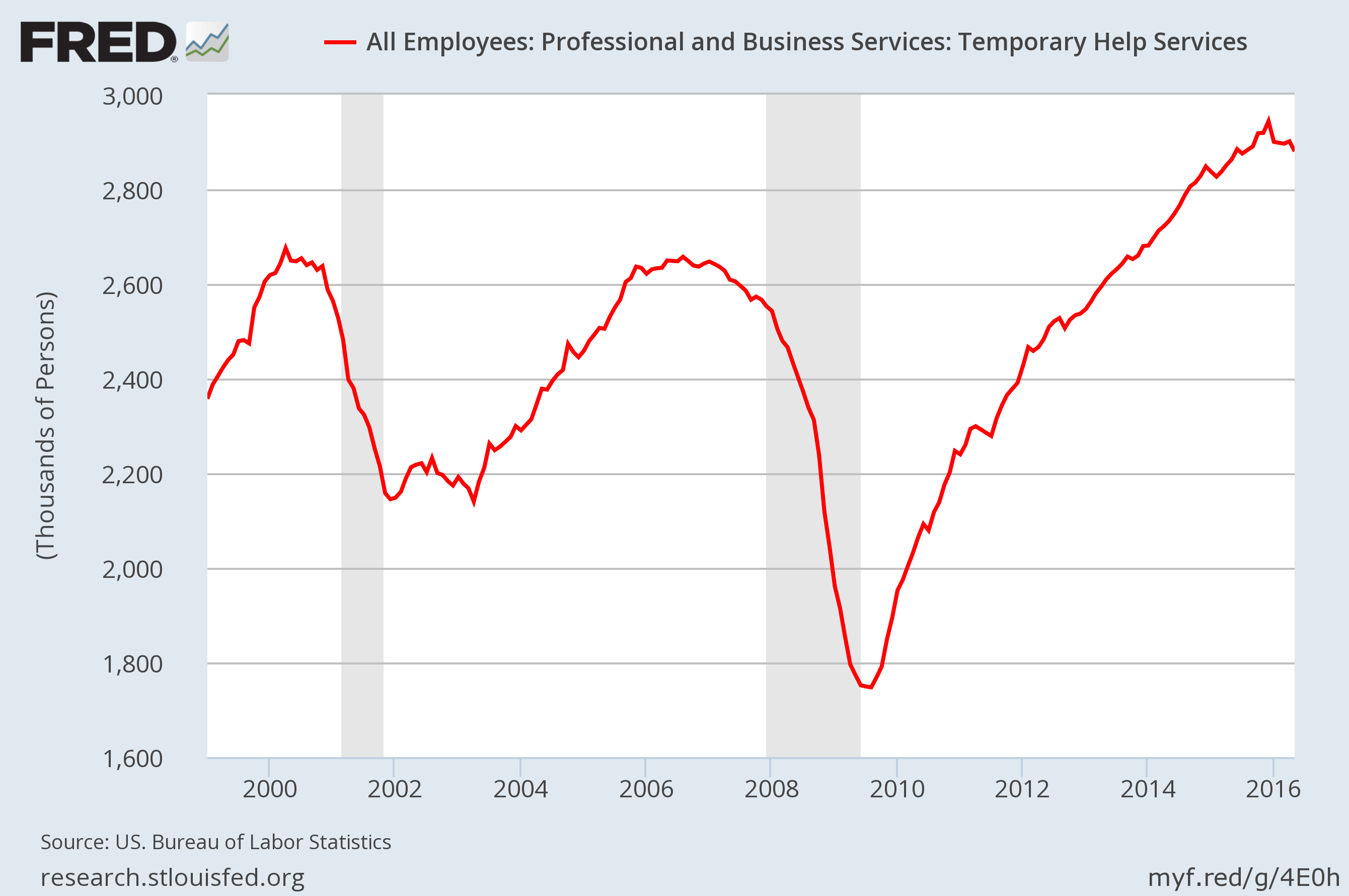

Five U.S. Banks Each Have More Than 40 Trillion Dollars In Exposure To Derivatives

When is the U.S. banking system going to crash?

Will gold and silver really be good investments when the financial system collapses?

Is silver really a good investment for barter? Should you invest in silver or gold for a safety net in case the economy gets worse? I’m going to go over the pluses and minuses of each and tell you what I think.