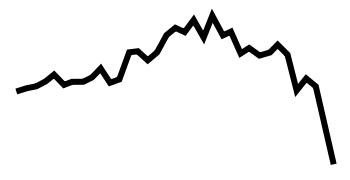

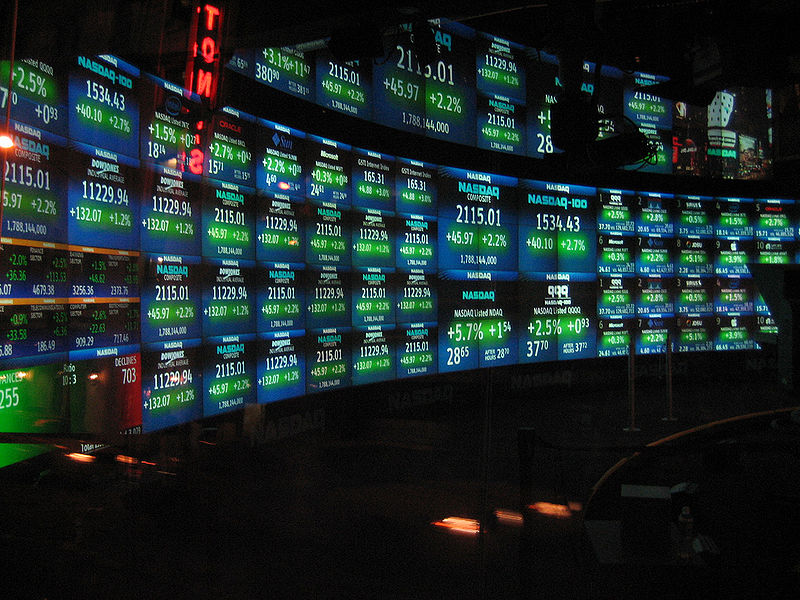

All 2014 Stock Market Gains Have Been Wiped Out

Stocks ended a bloody, turbulent week with a broad-based slump Friday, sending the tech-heavy Nasdaq to its worst weekly losses in 30 months and eviscerating what remained of the Dow Jones industrial average’s 2014 gains. The Dow, down 335 points Thursday in its worst single session performance of the year, fell another 115.15 points to 16,544.