Stocks

Are You Better Off This Thanksgiving Than You Were Last Thanksgiving?

Are you in better shape financially than you were last Thanksgiving? If so, you should consider yourself to be very fortunate because most Americans are not. As you chow down on turkey, stuffing and cranberry sauce this Thursday, please remember that there are millions of Americans that simply cannot afford to eat such a meal.

The Fed is worried about the stock market

The Federal Reserve is not supposed to care about the stock market. It only has two official mandates: make sure enough Americans are working and ensure prices of consumer goods stay relatively stable.

From This Day Forward, We Will Watch How The Stock Market Performs Without The Fed’s Monetary Heroin

Mark this day on your calendars. The Dow is at 16974, the S&P 500 is at 1982 and the NASDAQ is at 4549. From this day forward, we will be looking to see how the stock market performs without the monetary heroin that the Federal Reserve has been providing to it.

How Will The Stock Market React To The End Of Quantitative Easing?

It is widely expected that the Federal Reserve is going to announce the end of quantitative easing this week. Will this represent a major turning point for the stock market? As you will see below, since 2008 stocks have risen dramatically throughout every stage of quantitative easing.

Bond funds stock up on Treasuries in prep for market shock

U.S. corporate bond funds this year are adding Treasuries to their holdings at more than twice the rate of corporate debt amid concern that the struggling European economy and potential changes in Federal Reserve policy will drag down profits at U.

IMF Worries End of QE Will Trigger Stock Market Crash

It makes you wonder when the IMF (Interntional Monetary Fund) worries about individual investors selling stocks because of values “deteriorating unexpectedly”.Do they know something that we don’t? Is this a signal that the market is going to crash?

9 Ominous Signals Coming From The Financial Markets That We Have Not Seen In Years

Is the stock market about to crash? Hopefully not, and there definitely have been quite a few “false alarms” over the past few years. But without a doubt we have been living through one of the greatest financial bubbles in U.

After the VIX ‘super spike,’ is the worst ahead?

Technical strategist Abigail Doolittle is holding tight to her prediction of market doom ahead, asserting that a recent move in Wall Street’s fear gauge is signaling the way. Doolittle, founder of Peak Theories Research, has made headlines lately suggesting a market correction worse than anyone thinks is ahead. The long-term possibility, she has said, is a 60 percent collapse for the S&P 500.

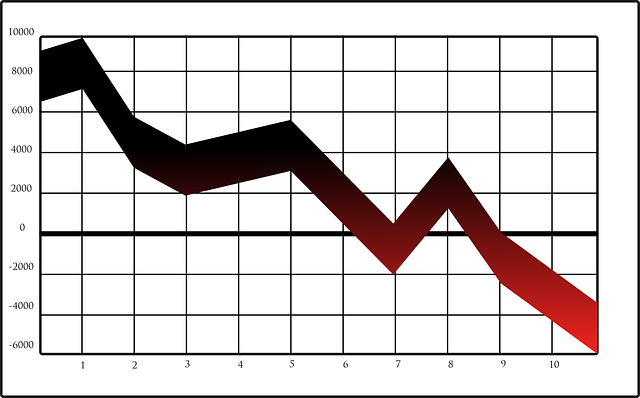

All 2014 Stock Market Gains Have Been Wiped Out

Stocks ended a bloody, turbulent week with a broad-based slump Friday, sending the tech-heavy Nasdaq to its worst weekly losses in 30 months and eviscerating what remained of the Dow Jones industrial average’s 2014 gains. The Dow, down 335 points Thursday in its worst single session performance of the year, fell another 115.15 points to 16,544.

Record S&P 500 Masks The Fact That 47 Percent Of Nasdaq Stocks Are Mired In Bear Market

About 47 percent of stocks in the Nasdaq Composite Index are down at least 20 percent from their peak in the last 12 months while more than 40 percent have fallen that much in the Russell 2000 Index and the Bloomberg IPO Index. That contrasts with the Standard & Poor’s 500 Index, which has closed at new highs 33 times in 2014 and where less than 6 percent of companies are in bear markets, data compiled by Bloomberg show. The divergence shows the appetite for risk is narrowing as the Federal Reserve reins in economic stimulus after a five-year rally that added almost $16 trillion to equity values.

Marc Faber: McDonald’s tells us why the market will collapse

Marc Faber has long predicted that a collapse in U.S. stocks is coming.

Most People Don’t Believe It, But We Are Right On Schedule For The Next Financial Crash

People have such short memories. Even though we are repeating so many of the same patterns that we witnessed in 2000-2001 and 2007-2008, most people do not think that another financial crash is coming. In fact, with the stock market setting record high after record high lately, I have been taking quite a bit of criticism for my relentless warnings about the coming financial storm.