Tech Stocks

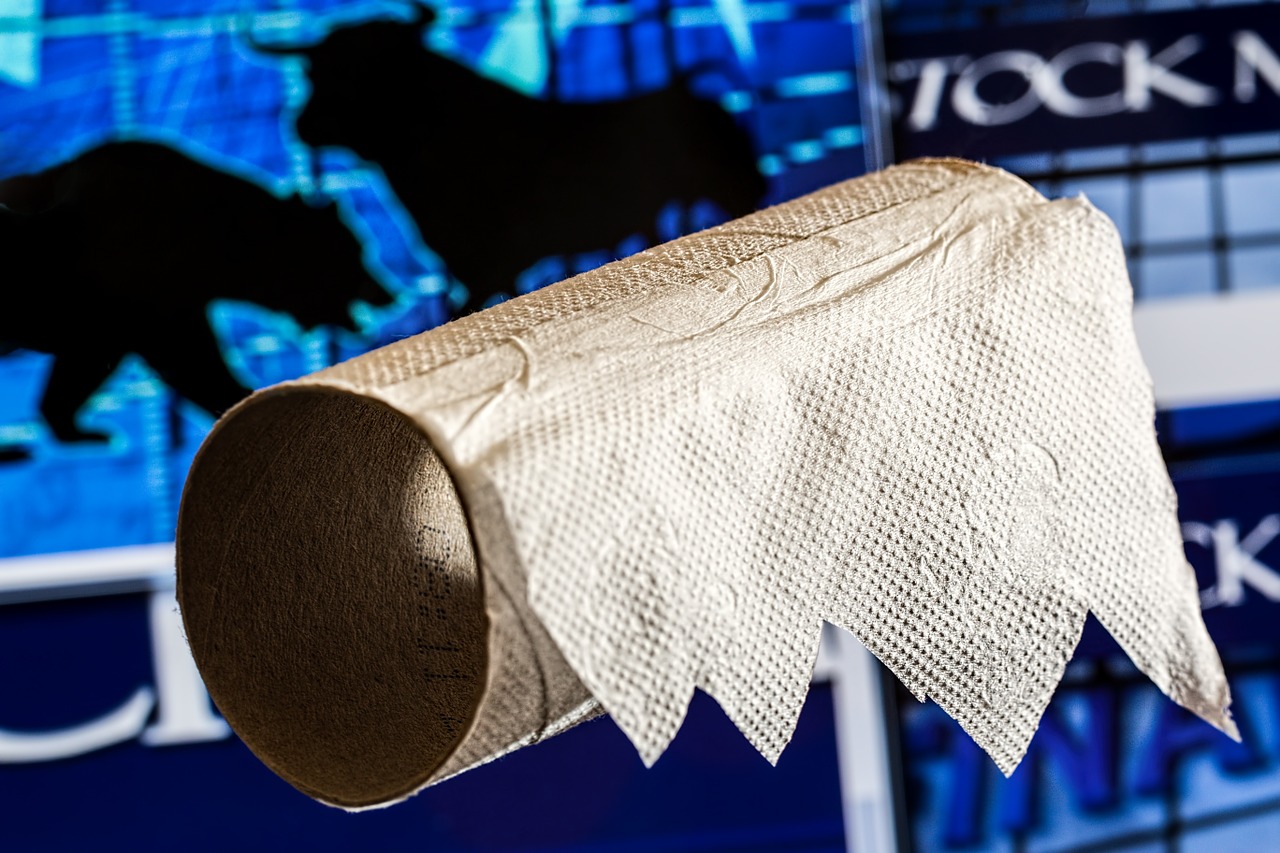

Silicon Valley Insider: ‘If 2000 Was A Bubble Factor Of 10, We Are At A 9 Right Now’

Facebook bought revenueless Instagram for $1 billion in 2012. Snapchat, the revenueless sexting app, is now valued at $10 billion. There are so many examples like this.